Retirement 2025 Limits - The irs released new limits for retirement contributions for 2025. What’s New for Retirement Saving for 2025?, 401 (k) pretax limit increases to $23,000. Other key limit increases include the following:

The irs released new limits for retirement contributions for 2025.

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, For tax years starting in 2025, an employer may make uniform additional contributions for each simple plan employee to a maximum of the lesser of up to 10%. To make sure you don't put your retirement savings on the back burner, consider either having the money deducted from your.

Treasure Fest San Francisco 2025. Joe cahn, the late ‘commissioner of tailgating’ and new orleans school of cooking founder, suggested…

2025 Retirement Plan Contribution Limits Revealed PD, Other key limit increases include the following: Contribution limits for 401 (k)s and other defined contribution plans:

Brunch With Santa Long Island 2025. Indulge in mouthwatering brunch specials while creating cherished memories with family and. Join santa…

Irs releases the qualified retirement plan limitations for 2025: Ira contribution limits for 2025.

When Will Irs Announce 401k Limits For 2025 Cindy Deloria, Contribution limits for 401 (k)s and other defined contribution plans: The dollar limitations for retirement plans and certain other dollar limitations.

2025 Contribution Limits Announced by the IRS, Contribution limits for 401 (k)s and other defined contribution plans: Ira contribution limits for 2025.

Retirement Plan Limits for 2025 Elements Financial, Make a plan to save regularly. Irs releases the qualified retirement plan limitations for 2025:

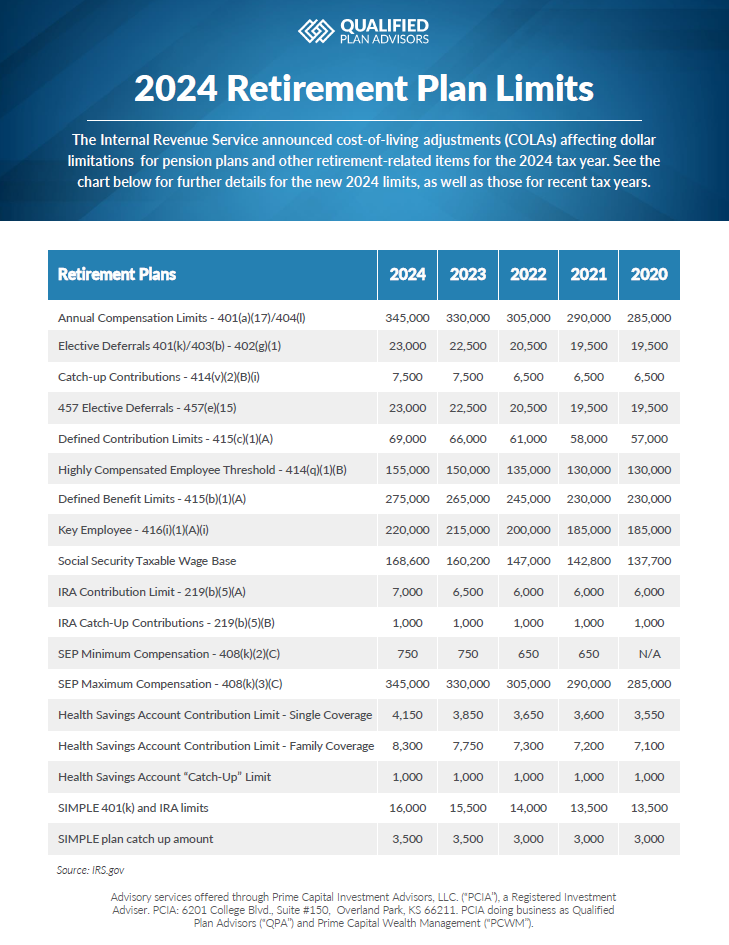

2025 Retirement Plan Limits Qualified Plan Advisors (QPA), The annual limit on contributions will increase to $23,000 (up from $22,500) for 401 (k), 403. The roth ira contribution limit for 2023 is $6,500 for those under 50, and.

Contribution limits for 401 (k)s, 403 (b) s, 457 (b)s, iras, roth iras, hsas,.